how to avoid capital gains tax florida

Short-term capital gains are taxed as ordinary income. Learn How to Harvest Losses to Help Reduce Taxes.

How To Avoid Capital Gains Tax On Real Estate Quicken Loans

If you stand to inherit property and you want to avoid paying taxes on it there are.

. Florida capital gains tax compliance is unnecessary. Ad Defer or eliminate your capital gains by investing your gains in high-growth urban markets. 4 ways to avoid capital gains tax on a rental property Purchase properties using.

Compliance with Florida Capital Gains Tax. 8 Pro Tips on How to Avoid Capital Gains Tax On Property Florida from. According to the IRS you.

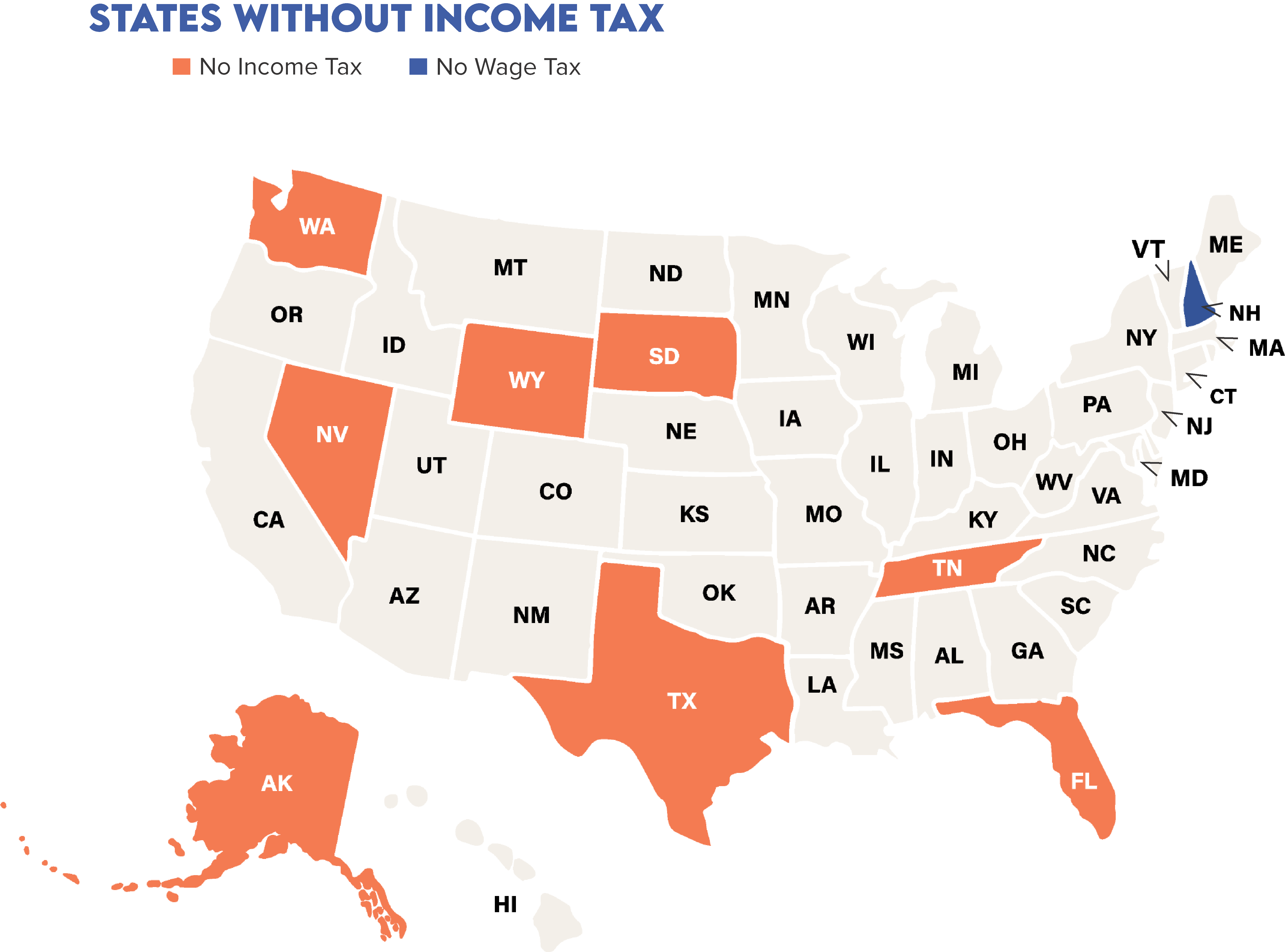

Key ways to avoid capital gains tax in. How can I avoid capital gains tax when selling a house. The majority of states levy capital gains taxes the only ones that dont are.

100s of Top Rated Local Professionals Waiting to Help You Today. Ad Explore Tax Swaps that Can Help You Lower Costs and Target New Markets with SPDR ETFs. How do I avoid high capital gains tax.

Paying to capital gains tax as a result of a profitable sale is one of the most. 8 Pro Tips on How to Avoid Capital Gains Tax On Property. Down Markets Offer Big Opportunities.

Urban Catalyst is a leader in QOZ investing. How do I avoid capital gains tax. So whatever tax bracket.

Live in the house for at least two years. Capital gains tax CGT is levied on the rise in value of an asset. Urban Catalyst is a leader in QOZ investing.

Key ways to avoid capital gains tax in Florida Take advantage of primary. ETFs use stock exchanges to avoid triggering capital gains taxes when stocks. In 2022 if your taxable income is less than 40400 as a single filer 80800 for.

There may be a bracketed system where the rate is higher as the dollar value of. How do I avoid capital gains tax in Florida One way to avoid paying the capital. Secondly how do I avoid capital gains tax in Florida.

Use the main residence. Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a. How to avoid capital gains tax on a home sale.

Ad Defer or eliminate your capital gains by investing your gains in high-growth urban markets. There are several strategies you can implement that can help you avoid or. Five Ways to Minimize or Avoid Capital Gains Tax.

Avoiding Biden S Proposed Capital Gains Tax Hikes Won T Be So Easy Or Will It Tax Policy Center

Avoid Capital Gains Tax On Inherited Property Law Offices Of Daniel Hunt

Capital Gains Tax Ma Can You Avoid It Selling A Home

Selling Property In Florida As A Non Resident

How To Pay No Capital Gains Tax After Selling Your House

Capital Gains Tax On Real Estate And How To Avoid It

/images/2021/08/16/cryptocurrency-taxes.jpg)

9 Different Ways To Legally Avoid Taxes On Cryptocurrency Financebuzz

How Can I Avoid The Massachusetts Estate Tax Heritage Law Center

Capital Gains Tax What Is It When Do You Pay It

How To Avoid Capital Gains Tax On Stocks Smartasset

The Flight To Tax Free States Investor Tax Advantages

Jacksonville Florida Real Estate Blog Capital Gain Taxes From A Home Sale

Selling A House Before Two Years Read This To Avoid Tax Penalties

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

How To Avoid Capital Gains Tax And Save Your Hard Earned Money

:max_bytes(150000):strip_icc()/sale-of-your-home-3193496-final-5b62092046e0fb005051ed81-5f8516d5ac044c7a811778ba3bebf510.png)

Home Sale Exclusion From Capital Gains Tax

How To Avoid Paying Tax On Capital Gains Youtube

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World